Mutual Funds and its Types

A mutual fund is a professionally managed investment fund that pools money from many investors to purchase securities. They are professionally managed in a way that when people invest in the mutual funds, they get the services of a team of professionals. By investing in mutual fund, one can gain the services of professional fund managers, who would otherwise be costly for an individual investor. Professional fund managers can assess the risk profile of the investments. Without investing a large amount of money, one can enjoy the services. Since many investors are investing small amounts in a single mutual fund, risk (if any) gets divided among all of them, so mutual funds are better options for investments. Investments in a stock market go up or down with the change in prices of the stocks, so the biggest risk in investing in Mutual Funds is the market risk because of the economic alterations.

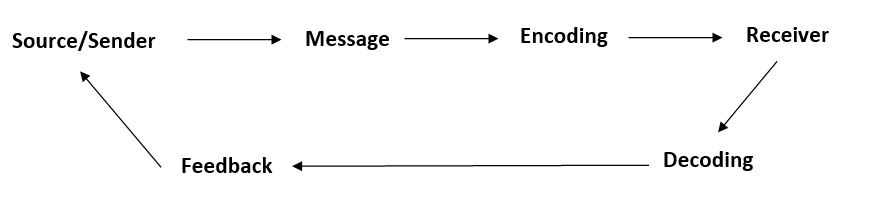

An investment in mutual fund follows the following cycle:

Open Ended: Under this scheme, the investors are free to buy or sell units at any point in time. This means that they do not have a maturity date. So your money is available to you any time you want. As new investors can purchase fresh units any day, the unit capital is case of an open-ended funds can fluctuate on daily basis.

Closed Ended: Under this scheme, there is a stipulated maturity period. The investors can invest only during the launch period known as the NFO (New Fund Offer) period. Unlike open-ended funds, unit capital in case of closed-ended funds does not fluctuate on daily basis. Interval Fund: This is a scheme which operates as a combination of open and closed ended schemes. It allows investors to trade units at pre-defined intervals.

No comments:

Post a Comment